salt tax deduction new york

Readers react to an editorial calling for the elimination of the deduction for state and local taxes and discuss how it affects the middle. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

Salt Deduction Cap Should Be Reformed Not Repealed Itep

Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently.

. New York has issued long. Scott is a New York. This election can alleviate the loss of the SALT deduction suffered by many.

The SALT cap limits a. To 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021. Leaders of the finance industry and other businesses in New York are pushing President Joe Biden and Senate Majority Leader Chuck Schumer to bring back the full state.

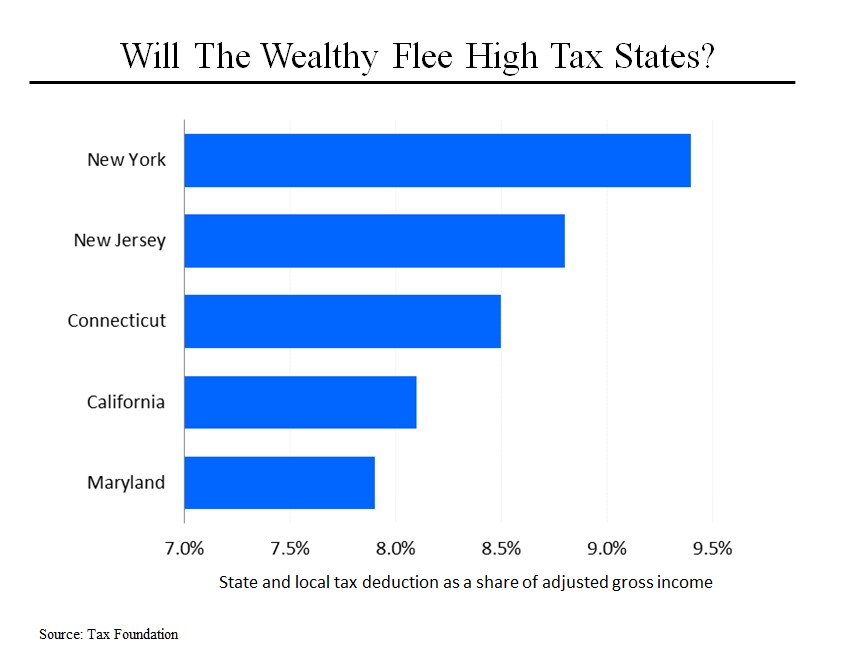

Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for. Salt tax deduction new york Thursday November 3 2022 Edit.

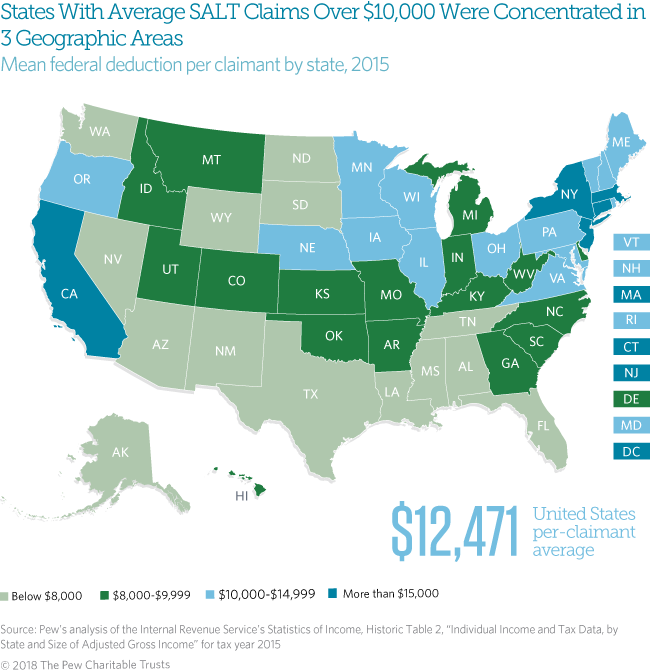

For example the average SALT deduction claimed in New York was 23804 in 2017 and 5451 in Alaska in the same year according to Internal Revenue Service data. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is. 52 rows The state and local tax deduction or SALT deduction for short allows taxpayers to deduct certain state and local taxes on their federal tax returns. The Debate Over a Tax Deduction.

Tom Suozzi has taken a leading role in fighting to restore a tax deduction that is important to people who. April 11 2021 700 pm ET. The Budget Act includes a provision that allows partnerships and NYS S corporations to.

The Pass-Through Entity tax allows an eligible entity. The deadline to elect into New Yorks entity-level tax workaround to the federal SALT cap is October 15 2021. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue. Published January 4 2022 at 506 PM EST.

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Shaking Up Your Salt Deductions Jmf

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

What Is The Salt Deduction H R Block

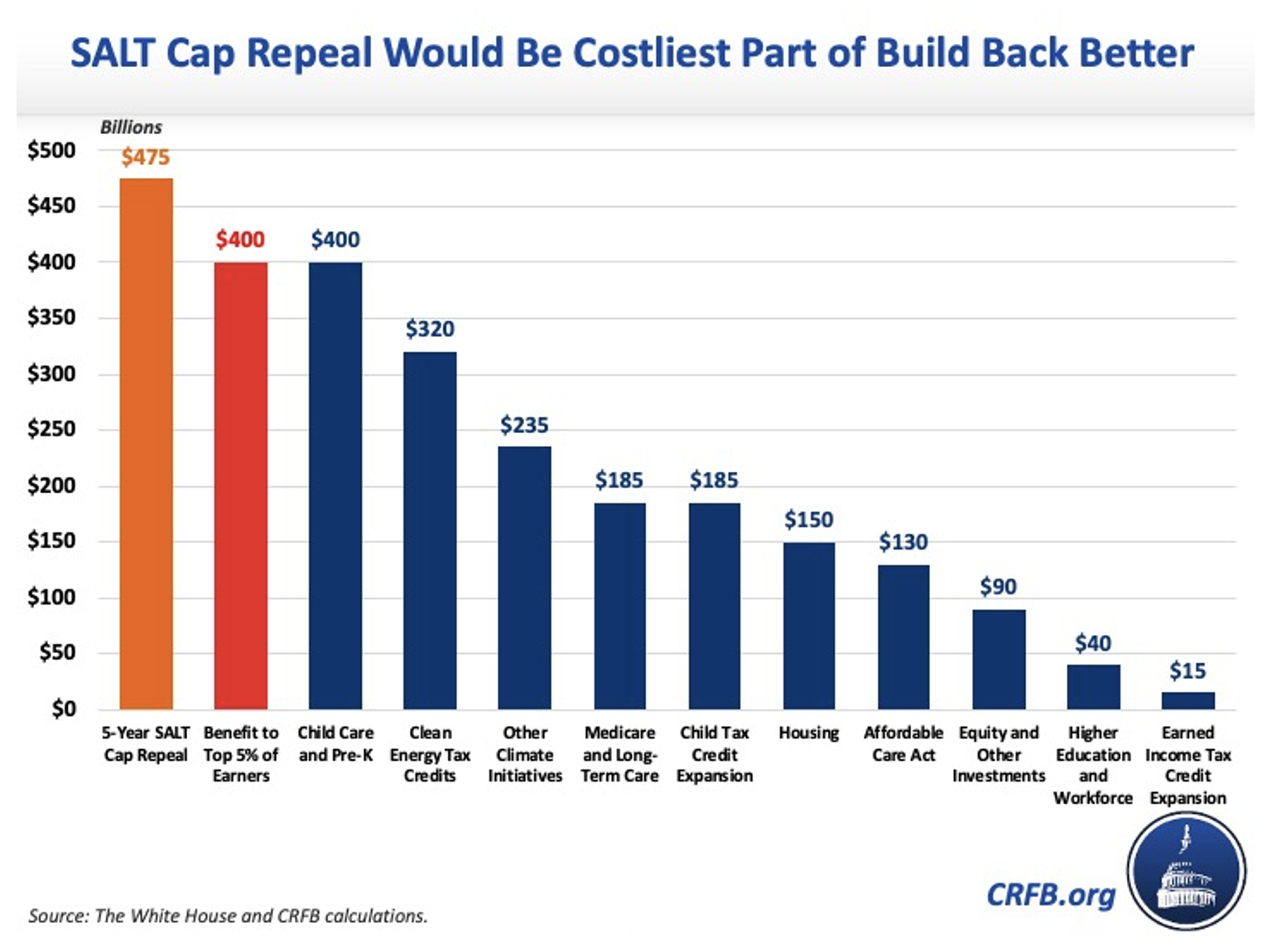

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

Salt Deduction Reinstatement Can Go A Long Way For Nj Ny Families

Scotus Swats Away Salt Cap Challenge That Limits Tax Deductions In New York Maryland Fox News

A Fight Between The Biden Administration And Coastal Democrats Could Be Headed For The Supreme Court The New Republic

New York Democrats Push Repeal Of Cap On Local Tax Deductions Wsj

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

Salt Deduction Limit Avoiding The 10 000 Federal Limitation In New York

States Help Business Owners Save Big On Federal Taxes With Salt Cap Workarounds Wsj

Gov Cuomo Proposes Adopting Payroll Tax In Response To Tax Law S Cap On Salt Deduction

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

Blue States Ask Supreme Court To Review Salt Tax Deduction Caps

Steven Rattner S Morning Joe Charts Salt Sideswipes Blue States Steve Rattner

New York State Elective Pass Through Entity Tax Salt Cap Workaround Dannible And Mckee Llp